As an Amazon Associate, I earn from qualifying purchases at no extra cost to you.

Does Car Insurance Cover Transmission? Discover the Comprehensive Protection You Need!

Car insurance generally does not cover transmission repairs or replacements.

1. Understanding Car Insurance Coverage

Car insurance is a crucial aspect of owning a vehicle. Understanding car insurance coverage is essential to ensure you have adequate protection in the event of an accident or damage. This section will discuss the types of car insurance coverage available and provide a closer look at comprehensive coverage.

1.1 Types Of Car Insurance Coverage

Car insurance coverage can vary depending on your specific needs and preferences. Here are some common types of coverage:

- Liability Coverage: This is the most basic form of car insurance coverage, required in most states. It covers damages and injuries you may cause to others in an accident.

- Collision Coverage: This coverage helps pay for damages to your own vehicle in a collision, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive coverage protects against damages to your vehicle that are not caused by a collision. This can include incidents such as theft, vandalism, weather-related damage, and fire.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

- Medical Payments Coverage: Medical payments coverage pays for medical expenses resulting from an accident, regardless of who is at fault.

1.2 Comprehensive Coverage

Comprehensive coverage is an integral part of car insurance that offers a wide range of protection for your vehicle. It covers damages that do not result from a collision, giving you peace of mind in situations that are beyond your control. This type of coverage is particularly important if you live in an area prone to theft, natural disasters, or other non-collision-related risks.

With comprehensive coverage, you can have financial support to repair or replace your vehicle if it is stolen, damaged by fire, or affected by severe weather conditions. It also covers damages caused by vandalism or animal-related accidents. Having comprehensive coverage can save you from bearing the entire financial burden of extensive repairs or the loss of your vehicle.

It’s worth noting that comprehensive coverage usually comes with a deductible, which is the amount you are responsible for paying before your insurance kicks in. Your insurance policy will specify the deductible amount, and you can choose a deductible that aligns with your budget and preferences.

While comprehensive coverage provides extensive protection, it’s important to review your policy documents thoroughly to understand the specific coverage limits and exclusions that apply. Talk to your insurance provider if you have any questions or need clarification on the details of your coverage.

In conclusion, understanding car insurance coverage is key to ensuring you have the right level of protection for your vehicle. Comprehensive coverage is an important component of car insurance, as it covers damages not caused by a collision. By familiarizing yourself with the types of coverage available, you can make informed decisions when selecting the right policy for your needs.

2. Does Car Insurance Cover Transmission?

When it comes to car insurance, one of the common questions that many car owners have is whether their insurance policy covers transmission issues. The transmission is an integral part of a vehicle’s drivetrain, responsible for transferring power from the engine to the wheels. So, it’s important to understand what car insurance typically covers, the limitations of coverage, and the transmission coverage options available.

2.1 What Does Car Insurance Typically Cover?

Car insurance typically covers various aspects of vehicle damage and liability, ensuring protection for the policyholder and their vehicle. Here’s a breakdown of what car insurance policies generally cover:

- Liability Coverage: This coverage protects you in case you cause an accident that results in bodily injury or property damage to others.

- Collision Coverage: Collision coverage pays for the damages to your own vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: Comprehensive coverage helps reimburse you for damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, natural disasters, or hitting an animal.

- Personal Injury Protection (PIP) or Medical Payments (MedPay) Coverage: PIP or MedPay coverage pays for medical expenses resulting from a car accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

2.2 Limitations Of Car Insurance Coverage

While car insurance provides valuable protection, it’s important to be aware of its limitations:

- Deductibles: Car insurance policies often have deductibles, which are the amounts you’re responsible for paying out of pocket before the insurance coverage kicks in.

- Policy Exclusions: Car insurance policies may have specific exclusions, such as damage caused by regular wear and tear, mechanical breakdowns, or intentional acts.

- Market Value: Car insurance typically pays out based on the market value of your vehicle, which means the insurance reimbursement may not cover the full cost of a new transmission.

2.3 Transmission Coverage Options

When it comes to transmission coverage, car insurance policies usually do not provide direct coverage for transmission repair or replacement resulting from mechanical breakdowns or regular wear and tear. However, there may be additional options available:

- Extended Warranty: Some car insurance companies offer extended warranty plans that may include coverage for transmission repairs. These plans provide added protection beyond basic insurance coverage.

- Added Coverage Endorsements: You may have the option to add specific endorsements to your car insurance policy that cover mechanical breakdowns, including transmission issues. These endorsements often come at an additional cost.

It’s essential to review your car insurance policy carefully and consider additional coverage options to ensure you have the necessary protection for transmission issues and other mechanical breakdowns. Understanding your insurance coverage and exploring available options can help you make informed decisions regarding your car’s protection.

3. Assessing The Need For Transmission Coverage

Car insurance coverage typically does not include transmission repairs, as it is considered a mechanical failure rather than an accident, but you should check with your specific policy to be certain. Assessing the need for transmission coverage can help you determine the best course of action for protecting your vehicle.

When it comes to car insurance, many drivers focus on coverage for accidents or theft, overlooking the importance of transmission coverage. However, a faulty transmission can result in costly repairs that are not covered by a standard insurance policy. In this section, we will assess the need for transmission coverage, considering its importance, calculating its value, and understanding the risks and costs involved.

3.1 Importance Of Transmission Coverage

A car’s transmission is a critical component that allows power to be transmitted from the engine to the wheels, enabling smooth and efficient operation. However, transmissions are prone to wear and tear over time, and repairs or replacements can be expensive. Having transmission coverage ensures that you are financially protected in case of any transmission-related issues.

Importantly, a faulty transmission can affect not only your driving experience but also the overall safety of your vehicle. Malfunctioning transmissions can lead to sudden stalls, gear slippage, or loss of power while driving, which can increase the risk of accidents.

3.2 Calculating The Value Of Transmission Coverage

Calculating the value of transmission coverage involves considering the potential repair or replacement costs of a faulty transmission. Repairs can range from simple fixes to complete transmission replacements that can cost thousands of dollars.

To assess the value, consider the make and model of your vehicle, its age, and the expected lifespan of the transmission. Additionally, evaluate the cost of transmission coverage relative to the potential repair or replacement costs. While transmission coverage may increase your insurance premium slightly, it can save you from the financial burden of major transmission repairs down the road.

3.3 Risks And Costs Involved

When deciding whether to opt for transmission coverage, it is essential to weigh the risks and costs involved. Without transmission coverage, you may be left responsible for the full cost of transmission repairs or replacements, which can be a significant financial setback.

While transmission coverage helps mitigate these risks, it is important to review the specifics of your insurance policy. Some policies may have limitations or exclusions, so carefully read the terms and conditions to understand the extent of coverage provided.

In addition, consider factors such as your driving habits and the condition of your vehicle. If you frequently drive in stop-and-go traffic or put heavy strain on your transmission, the likelihood of experiencing transmission issues increases. This increases the importance of having appropriate coverage.

By assessing your needs for transmission coverage, including evaluating its importance, calculating its value, and considering the risks and costs involved, you can make an informed decision regarding the appropriate level of coverage for your car insurance.

Credit: www.progressive.com

4. Understanding Transmission Repairs And Replacements

Car insurance coverage for transmission repairs and replacements varies depending on the policy. It’s recommended to review your insurance policy and contact your provider to understand the extent of coverage for transmission issues.

Car insurance plays a crucial role in protecting your vehicle from unexpected damages and repairs. But what about your transmission? Are transmission repairs and replacements covered by car insurance? In this section, we will delve into the topic of transmission repairs and replacements, exploring common transmission problems, the choice between repair and replacement, and typical costs involved.4.1 Common Transmission Problems

Transmission problems can arise due to various factors, leading to issues that require repairs or replacements. Here are some common transmission problems you might encounter:- Slipping gears: Your transmission may start slipping, causing the gears to change irregularly and resulting in a loss of power.

- Delayed engagement: When you shift into gear, you might experience a delay before the transmission engages, indicating potential problems.

- Leaking fluid: Transmission fluid leaks can occur due to faulty seals or gaskets, leading to a decline in performance and potential damage to the transmission system.

- Strange noises: Unusual noises, such as grinding, whining, or clunking, can indicate internal damage in the transmission that requires attention.

4.2 Repair Vs. Replacement

When faced with transmission issues, you might wonder whether a repair or a complete replacement is necessary. Factors such as the extent of the damage, the age of your vehicle, and the cost-effectiveness of each option come into play. Let’s examine the differences between transmission repair and replacement:| Transmission Repair | Transmission Replacement |

|---|---|

| Often involves fixing specific components or replacing damaged parts, without replacing the entire transmission system. | Involves removing the existing transmission and installing a new or remanufactured unit. |

| Can be a more cost-effective solution, particularly for minor issues or when the vehicle is relatively new. | May be necessary for extensive damage or when the transmission is nearing the end of its lifespan. |

| Requires skilled mechanics who specialize in transmission repairs. | Requires more labor and can be a time-consuming process. |

4.3 Typical Costs

The cost of transmission repairs or replacements can vary depending on factors such as your location, the make and model of your vehicle, and the severity of the issue. Here are some typical cost ranges you might encounter:- Transmission repairs: The cost for repairing minor transmission issues can range from $300 to $1,500.

- Transmission replacements: Replacing a transmission can cost anywhere from $2,000 to $8,000, depending on the complexity and availability of parts.

- Labor costs: Labor charges for transmission repairs or replacements can add an additional $500 to $1,500 to the overall expenses.

5. Choosing The Right Car Insurance Policy

When it comes to choosing the right car insurance policy, several factors need to be taken into consideration. From coverage limits to optional add-ons, evaluating insurance providers and understanding their policies is essential. By selecting the appropriate car insurance policy, you can have peace of mind knowing that you and your vehicle are adequately protected.

5.1 Factors To Consider

Before finalizing your car insurance policy, there are a few crucial factors to consider:

- Legal Requirements: Ensure that your policy meets the minimum legal requirements for car insurance in your area. This will vary depending on the country or state you reside in.

- Coverage Types: Evaluate the different coverage options available, such as liability coverage, collision coverage, and comprehensive coverage. Assess your needs and select the appropriate coverage types that provide sufficient protection for your vehicle.

- Deductibles: Take into account the deductibles associated with your policy. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Select a deductible that is affordable for you.

- Policy Limits: Understand the limits of your car insurance policy. This includes both liability limits and coverage limits for physical damage to your vehicle. It’s important to select policy limits that adequately safeguard your financial interests.

- Claims Process: Research and evaluate the claims process of each insurance provider. A smooth and efficient claims process can make a considerable difference in the event of an accident or damage to your vehicle.

5.2 Optional Add-ons

In addition to standard coverage options, many car insurance providers offer optional add-ons that can enhance your policy:

- Rental Car Coverage: This add-on provides coverage for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Consider adding roadside assistance coverage that offers services like towing, flat tire changes, and jump-starts in case of emergencies.

- Glass Coverage: Glass coverage protects you from the expenses associated with repairing or replacing damaged windshields or windows.

- Gap Insurance: If you have a leased or financed vehicle, gap insurance covers the difference between the actual cash value of your car and the remaining balance on your loan or lease.

5.3 Evaluating Insurance Providers

When evaluating insurance providers, keep the following factors in mind:

| Factor | Description |

|---|---|

| Financial Stability | Check the financial strength ratings of insurance companies to ensure they have the ability to pay claims efficiently. |

| Customer Service | Consider reviews and ratings to gauge the quality of customer service provided by different insurance providers. |

| Premium Costs | Compare premium costs from various insurance companies to find a policy that offers good coverage at an affordable price. |

| Discounts | Look for available discounts for safe driving records, multiple policies, vehicle safety features, and other factors that can help lower your premium. |

By carefully considering these factors, you can choose the right car insurance policy that suits your specific needs. Remember, it’s important to regularly review your policy to ensure it continues to meet your requirements and offers adequate coverage.

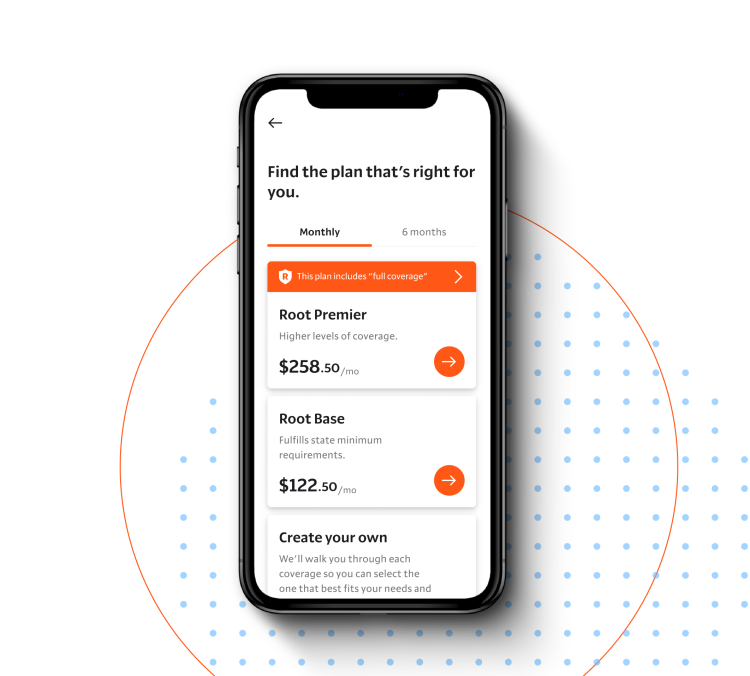

Credit: www.joinroot.com

:max_bytes(150000):strip_icc()/how-car-insurance-companies-value-cars.asp-final-e3fe7d12f1fc4cb9bef0d86ca31d28c4.jpg)

Credit: www.investopedia.com

Frequently Asked Questions On Does Car Insurance Cover Transmission

Is Transmission Failure Covered By Insurance?

Yes, transmission failure may be covered by insurance. However, coverage varies depending on the specific policy and the cause of the failure. Check with your insurance provider to understand if transmission failure is included in your policy.

Does Insurance Cover Car Engine Failure?

Yes, car engine failure can be covered by insurance.

Does Geico Cover Transmission Failure?

Yes, Geico does cover transmission failure under certain circumstances. It’s best to review your policy or contact Geico directly to confirm coverage details.

Does Insurance Cover Clutch Replacement?

Insurance coverage for clutch replacement varies depending on the policy. Check your policy or contact your insurance provider to determine if clutch replacement is covered.

Does Car Insurance Cover Transmission Problems?

Yes, car insurance typically covers transmission problems if they are the result of a covered incident, such as an accident.

Will My Car Insurance Cover Transmission Repairs?

Car insurance may cover transmission repairs if they are deemed necessary due to a covered accident or incident.

What Types Of Car Insurance Cover Transmission Damage?

Comprehensive and collision insurance are the most common types of coverage that may cover transmission damage.

Are There Any Exclusions To Car Insurance Coverage For Transmission Issues?

Some car insurance policies may have exclusions for pre-existing transmission problems or wear and tear.

Conclusion

The coverage provided by car insurance for transmission issues varies depending on the type of policy you have. Comprehensive insurance typically does not cover mechanical breakdowns like transmission failures, while a more specialized mechanical breakdown insurance may offer coverage. It’s crucial to carefully review your policy to understand what is and isn’t covered when it comes to transmission repairs or replacements.